ESG Management

-

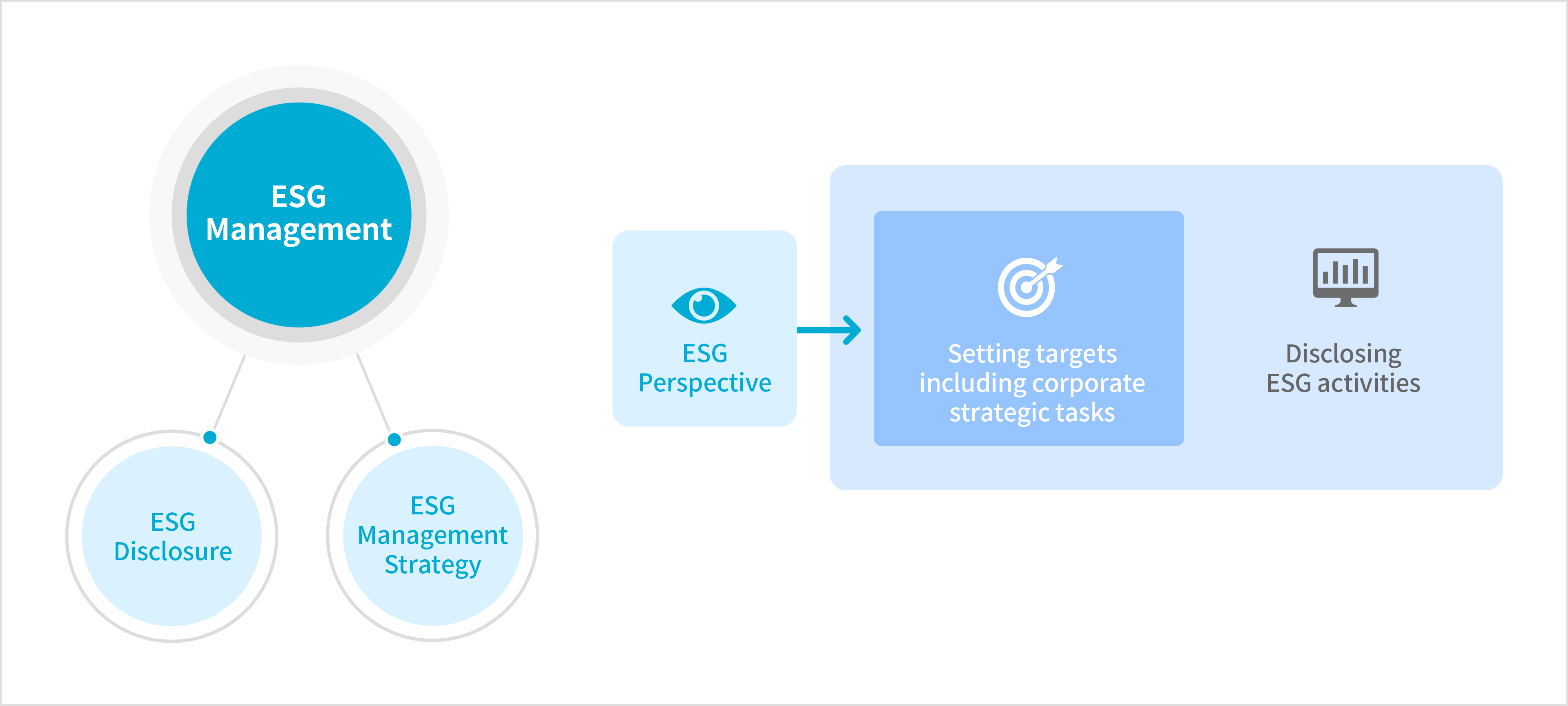

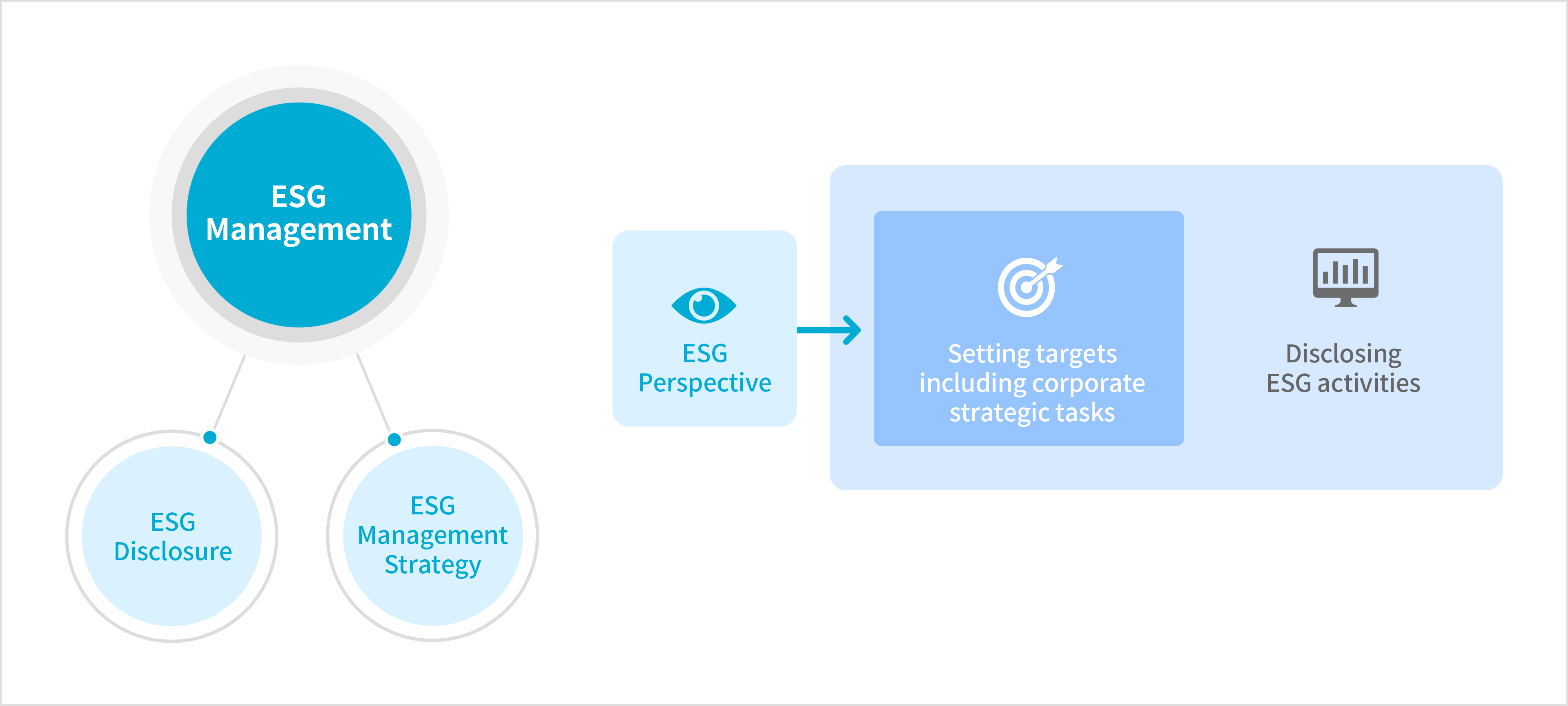

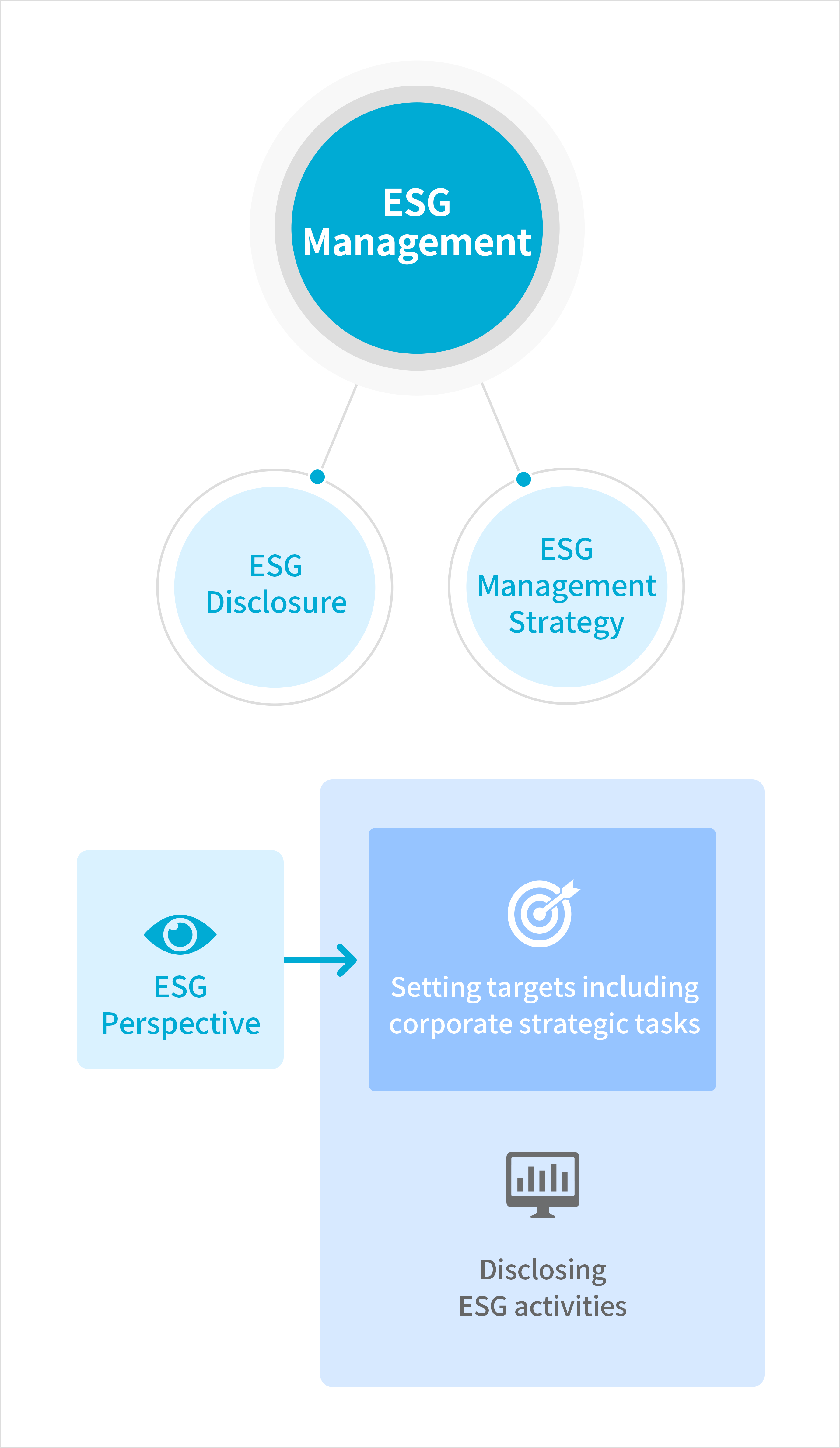

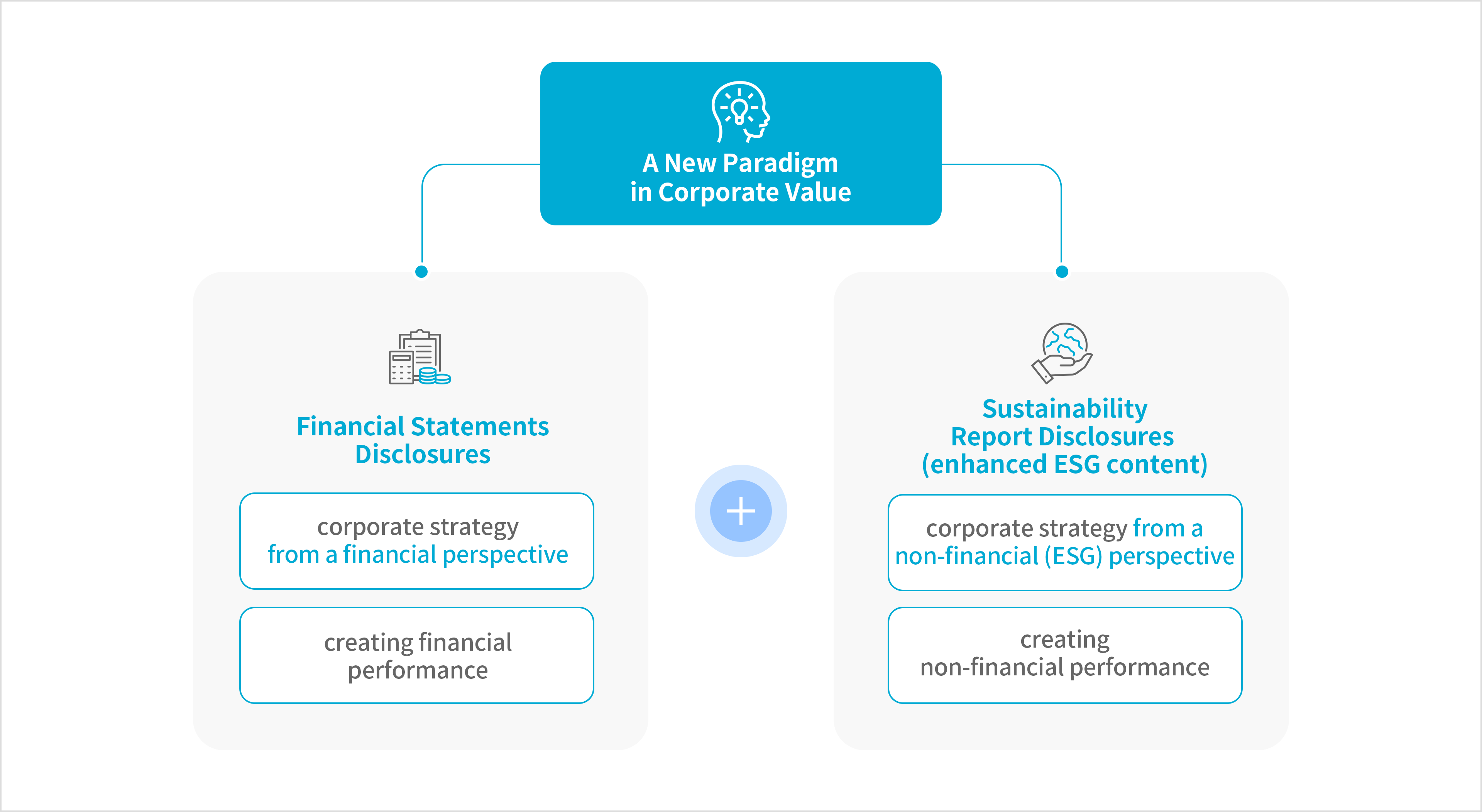

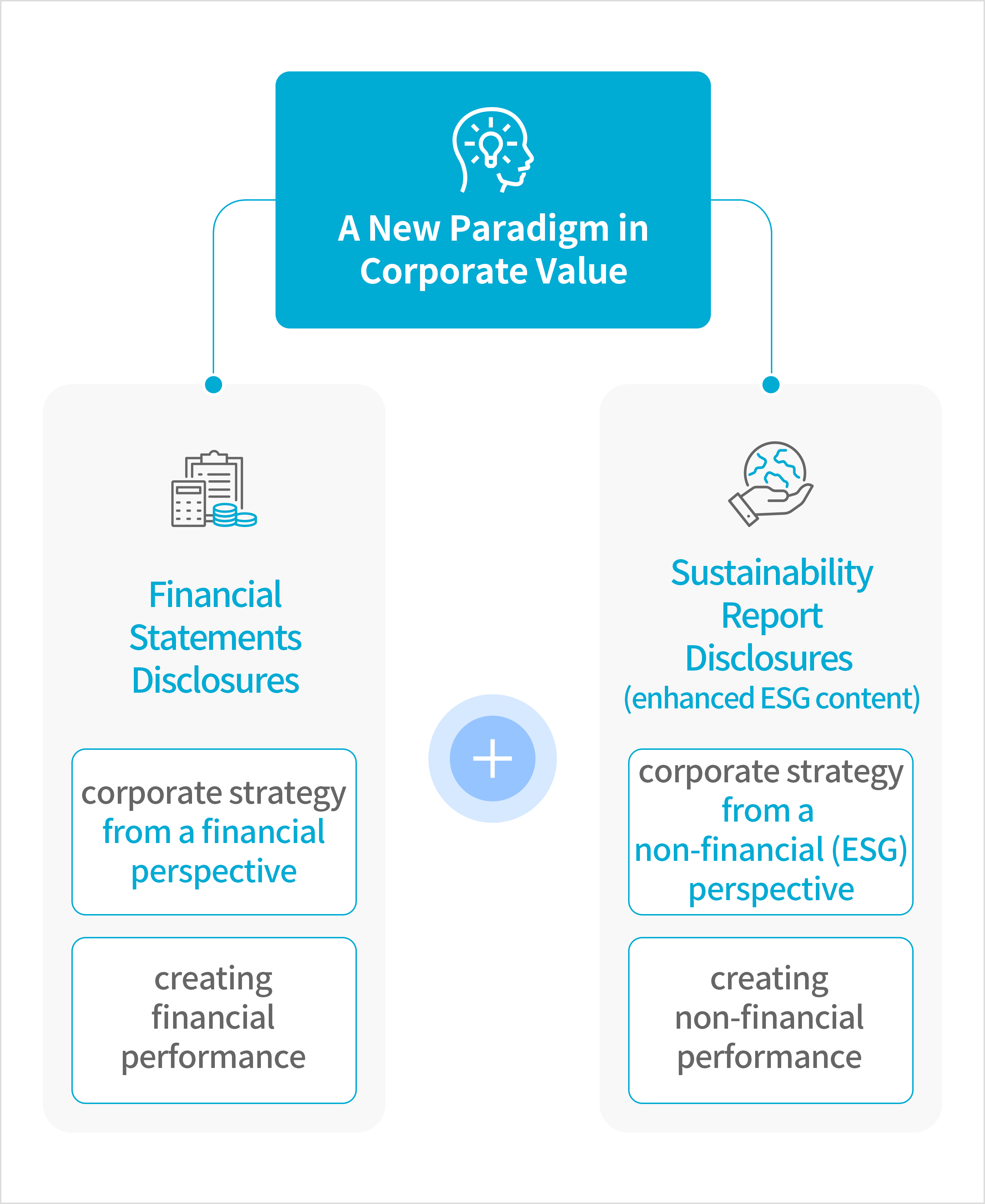

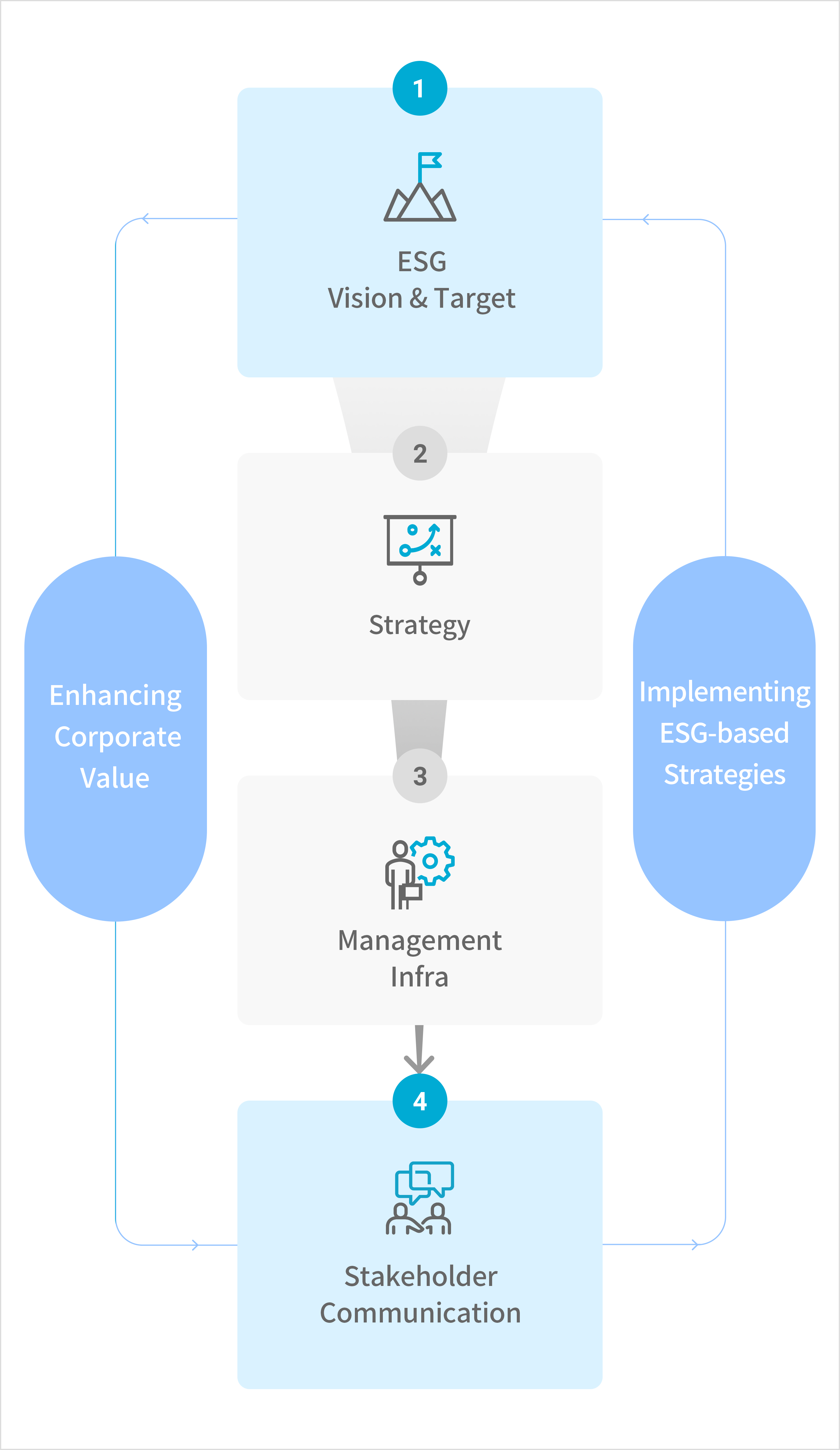

ESG management requires a well-developed ESG management strategy and ESG disclosure systems.

Corporate values can be enhanced by ESG management that sets corporate strategic tasks in the ESG perspectives and discloses the relevant activities.

- ESG Management Strategy

-

ESG management is often perceived as merely responding to ESG assessments to obtain favorable ratings. However, as seen in past cases such as Volkswagen’s Clean Diesel scandal, an approach to ESG driven primarily by ratings and marketing can be as risky as accounting fraud. Effective ESG management requires companies to integrate ESG considerations into their overall business by reshaping their vision, goals, and strategies accordingly.

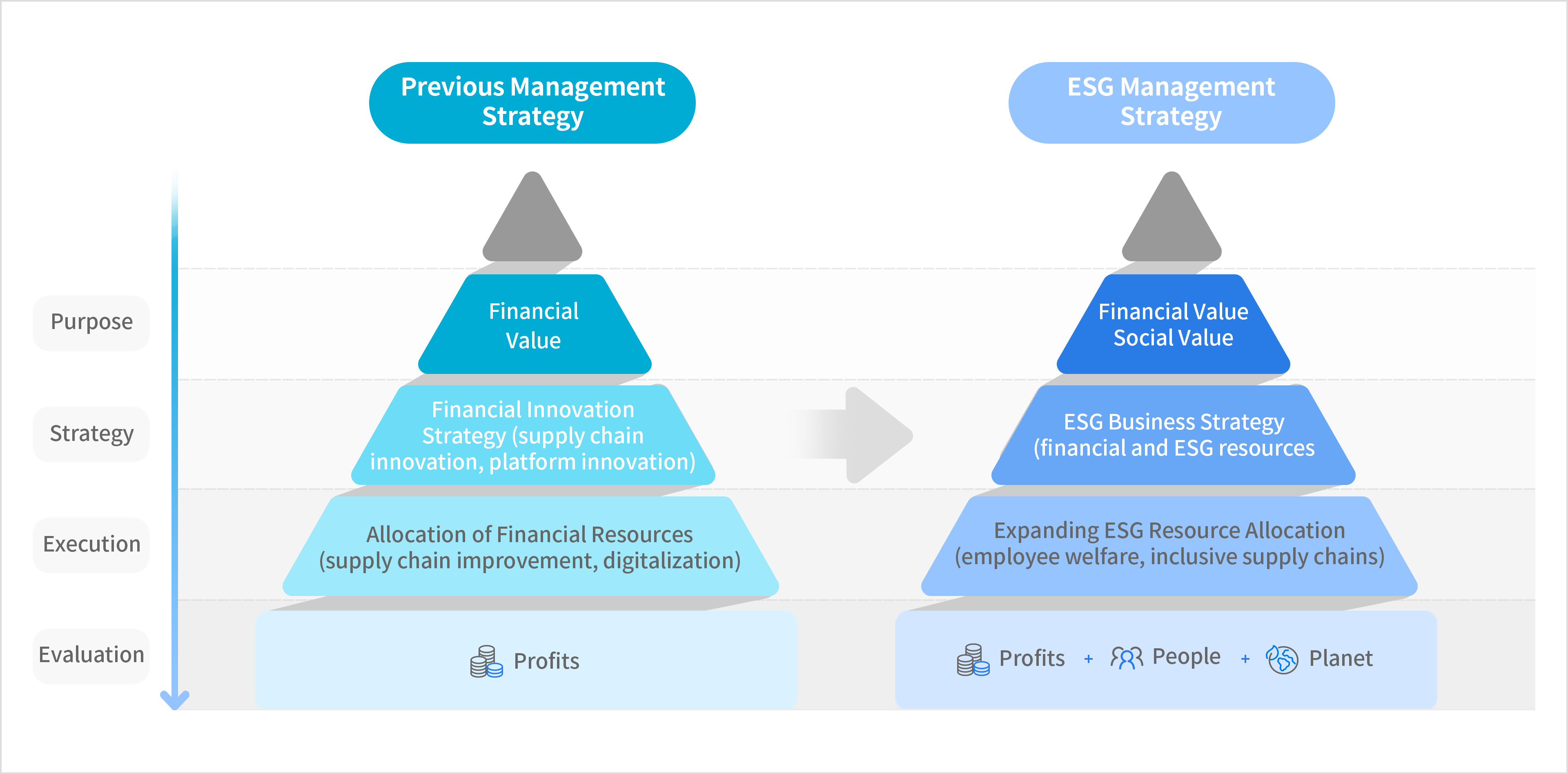

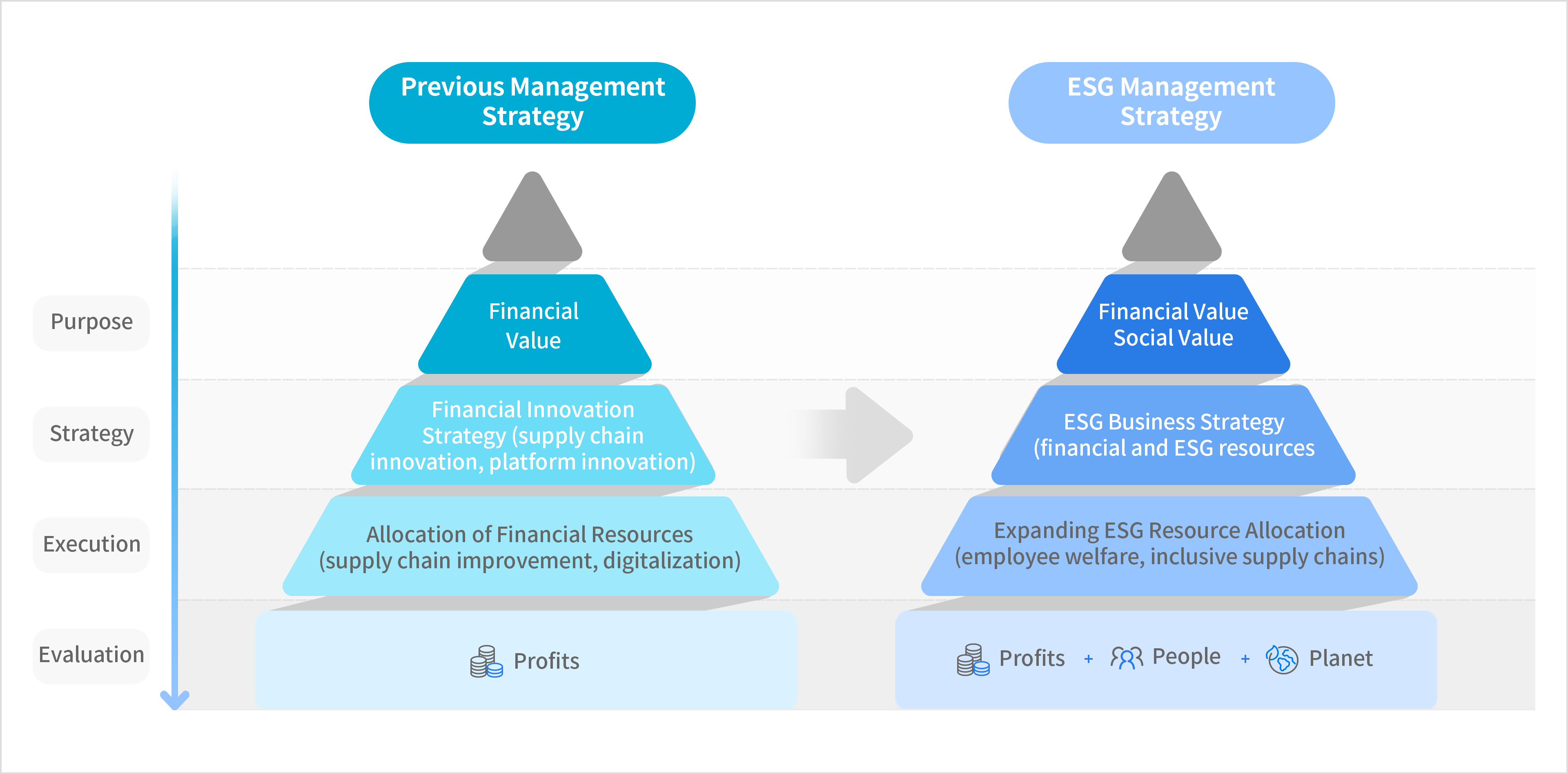

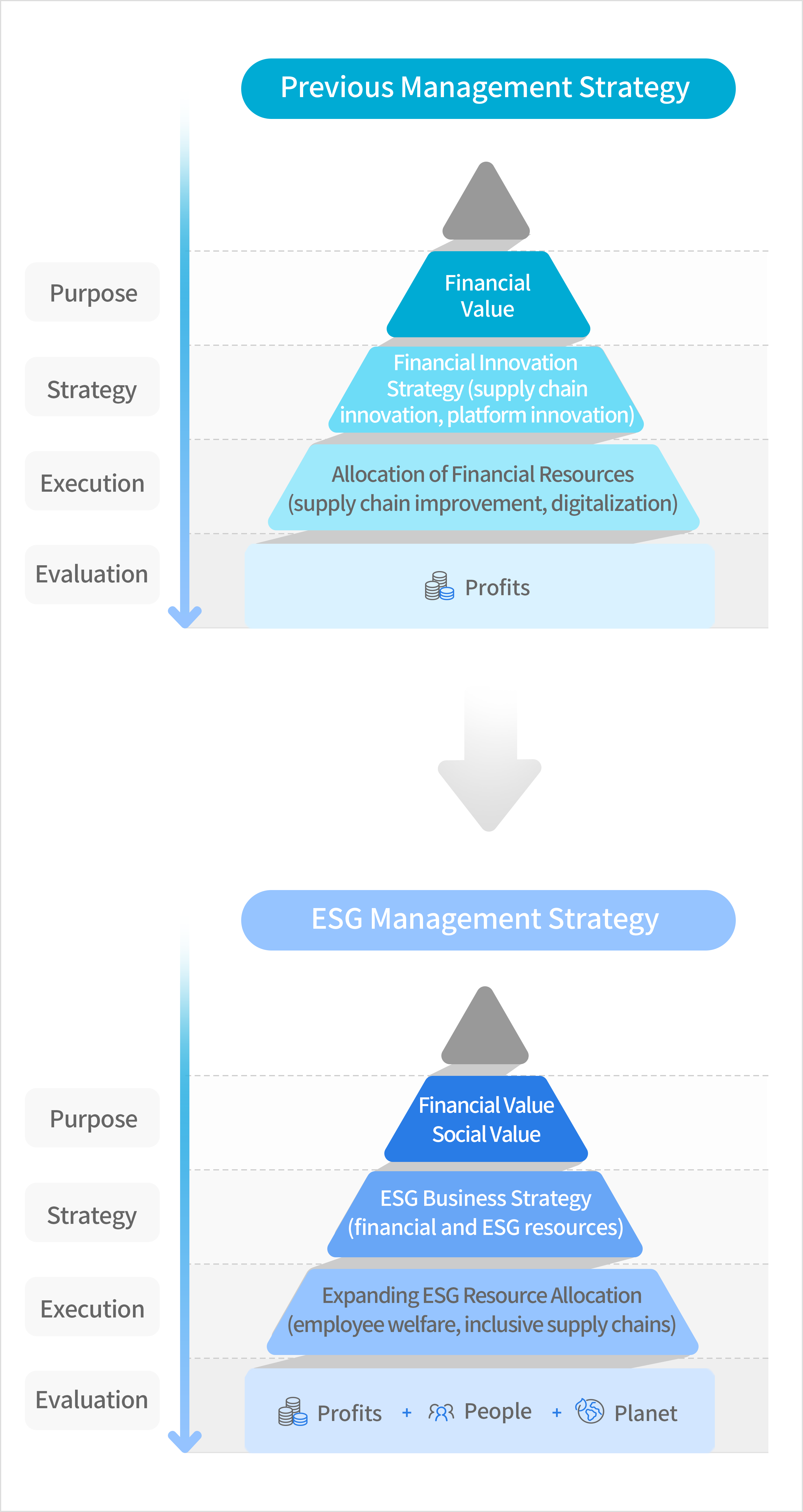

Source: Samjong KPMGESG management begins not only with responding to ESG-related regulations and reviewing ESG impacts in investment and financing activities, but also with considering the social impacts of companies’ products and services across the entire lifecycle—from production supply chains to end-of-life disposal.

Source: Samjong KPMGESG management begins not only with responding to ESG-related regulations and reviewing ESG impacts in investment and financing activities, but also with considering the social impacts of companies’ products and services across the entire lifecycle—from production supply chains to end-of-life disposal.

Source: Samjong KPMG

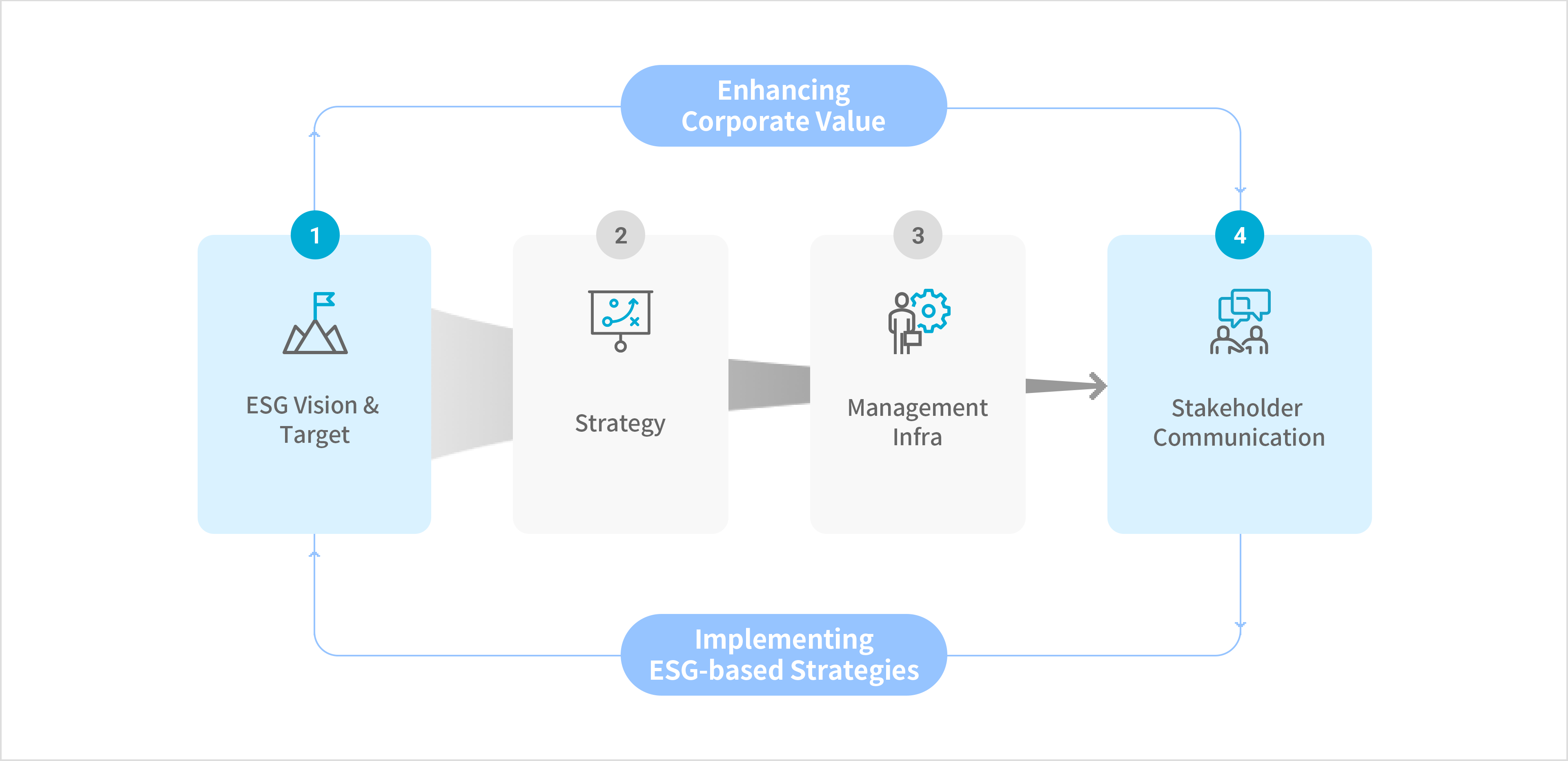

Source: Samjong KPMG - Steps in ESG Management Planning

-

Source: Korea Capital Market Institute (KCMI)

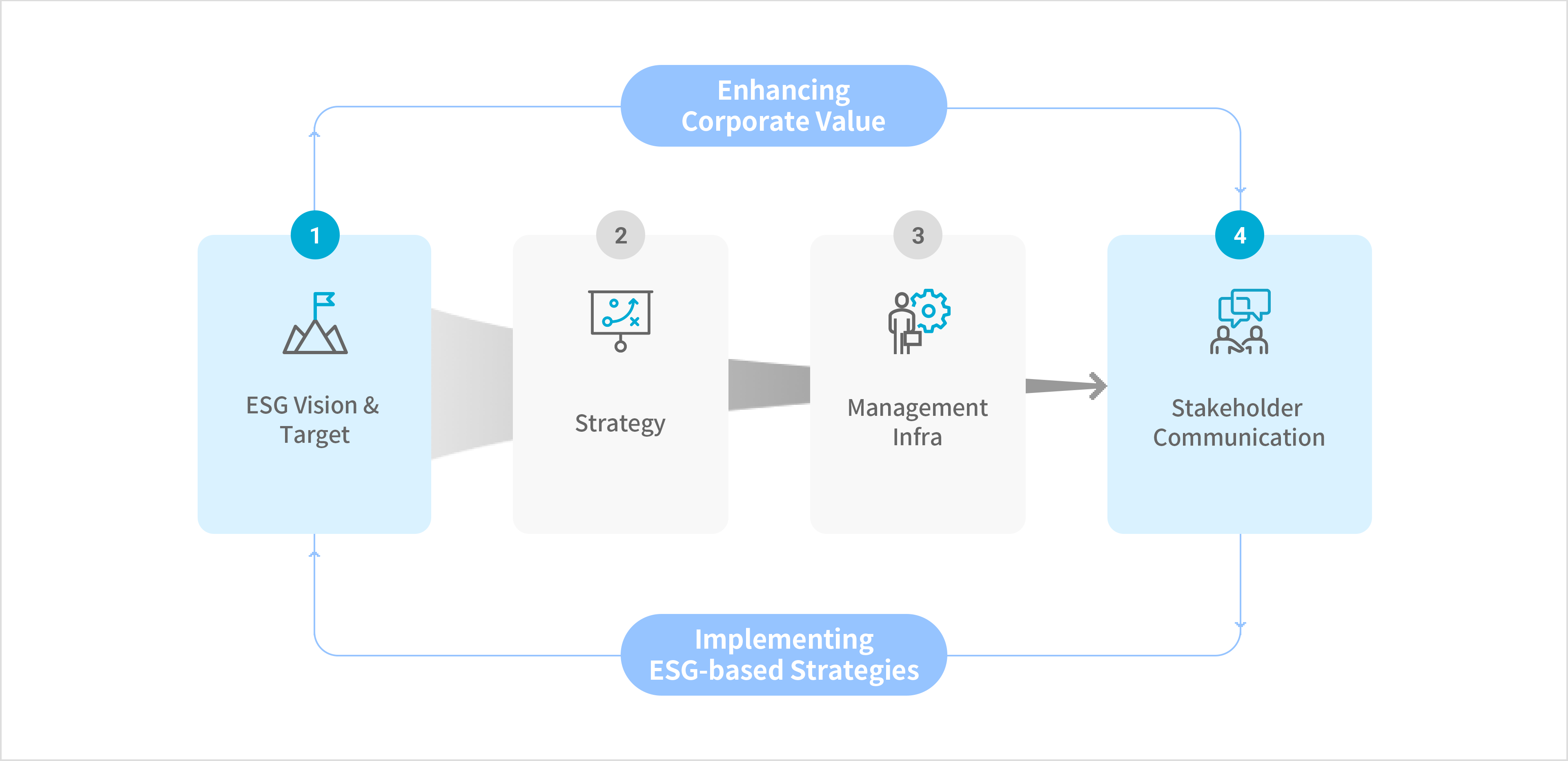

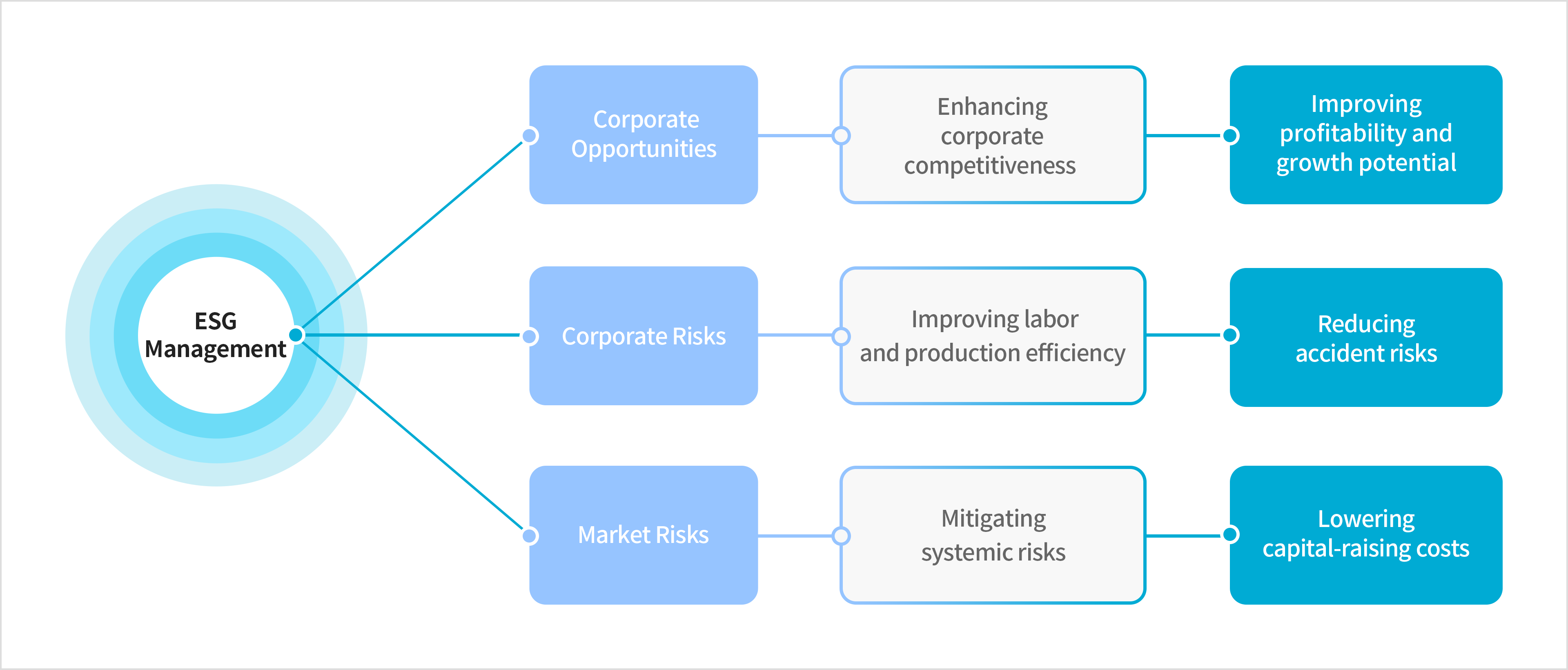

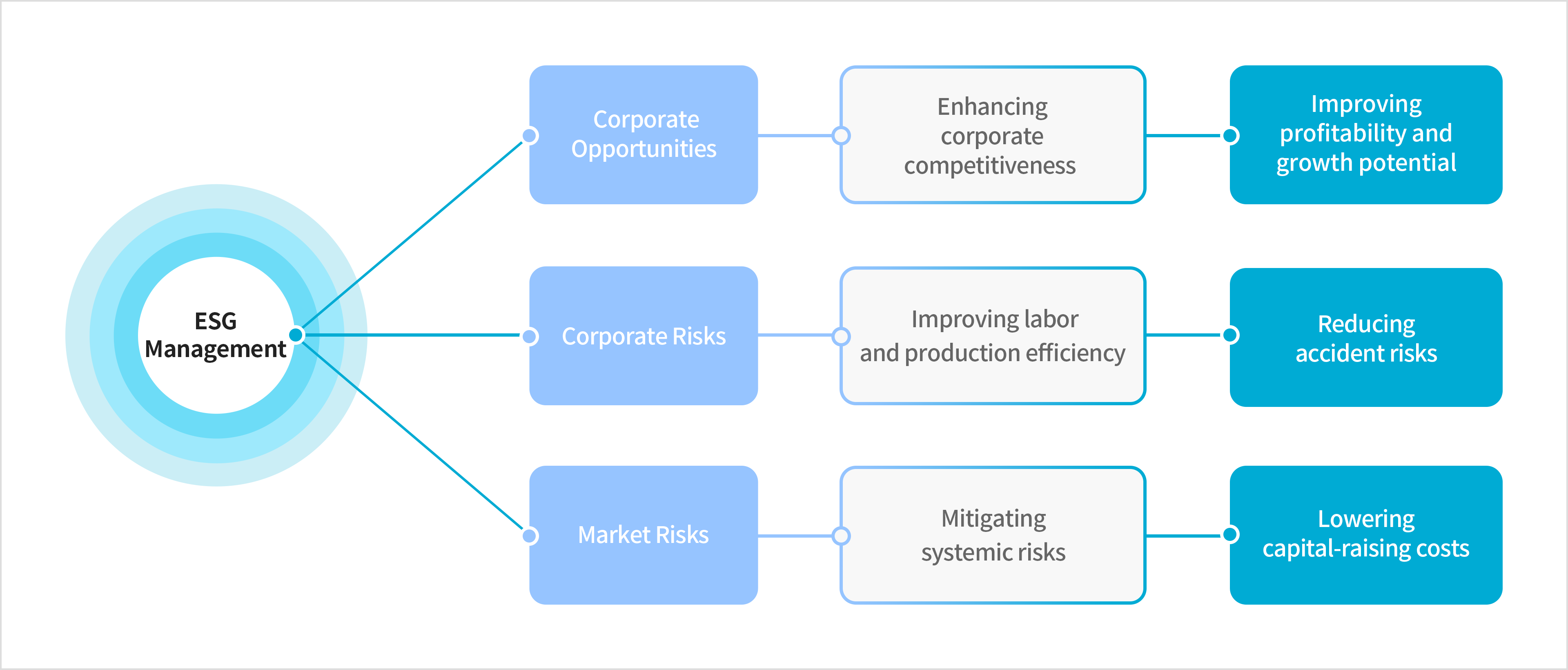

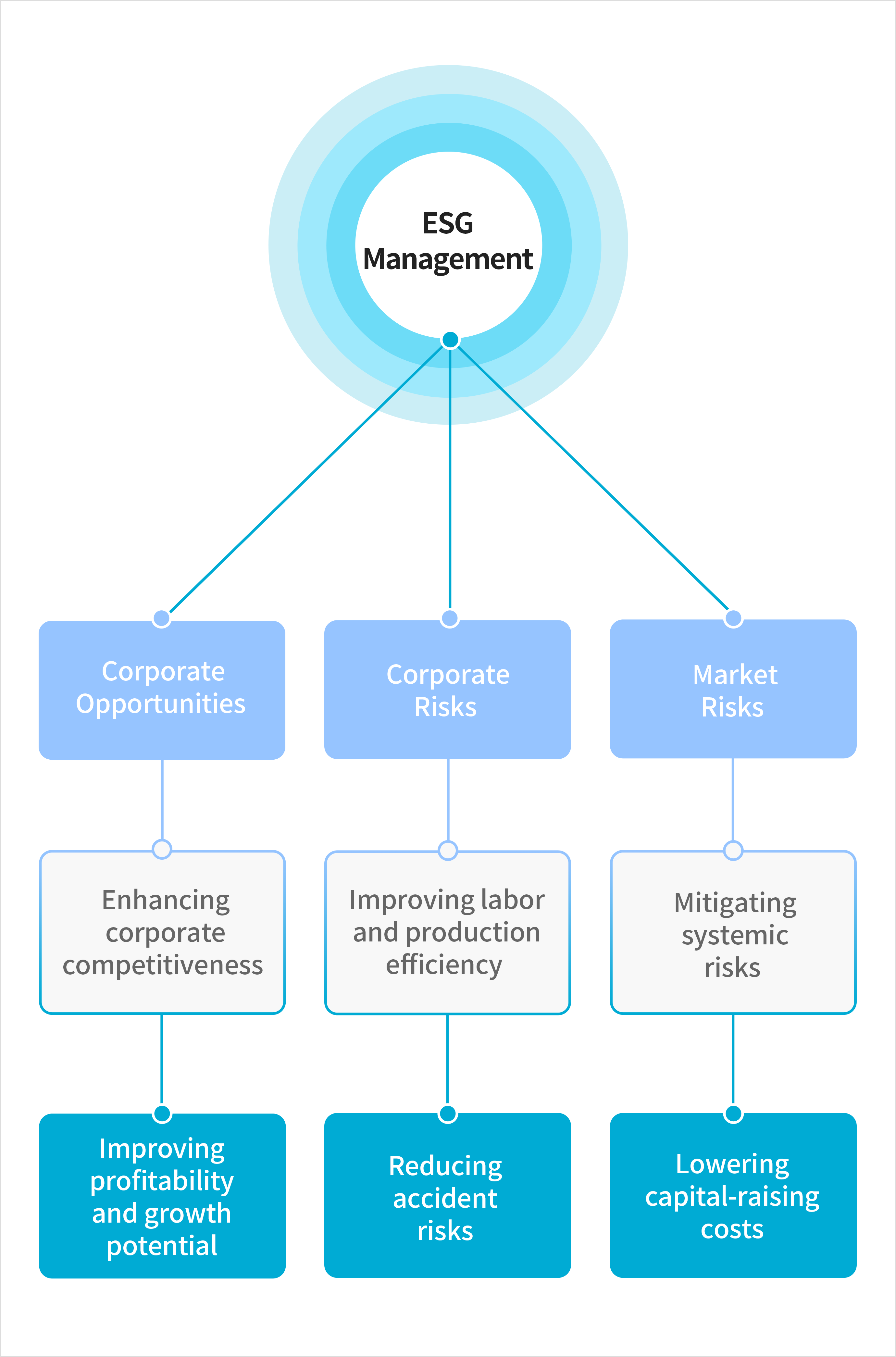

Source: Korea Capital Market Institute (KCMI) - Enhancing Corporate Value through ESG Management

-

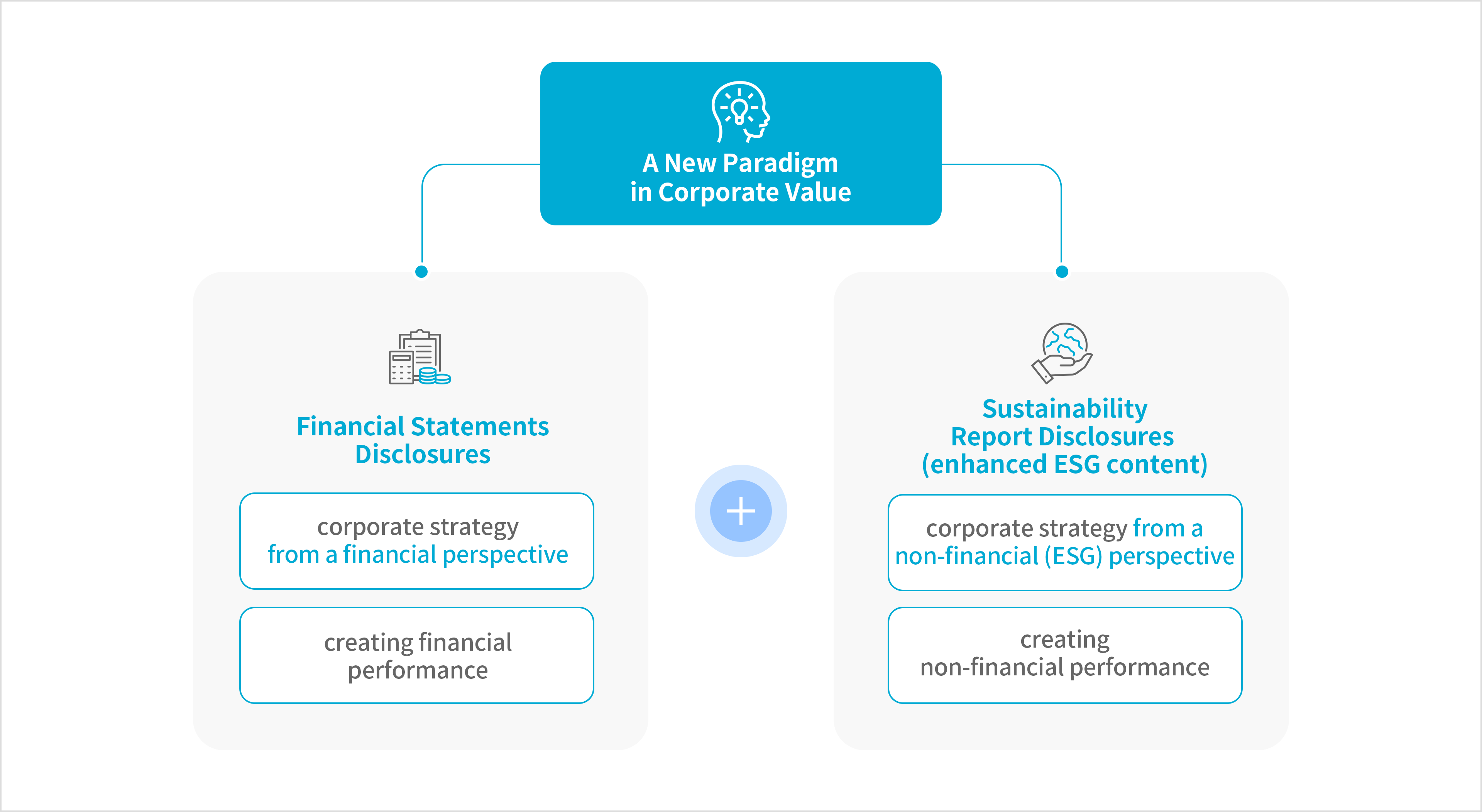

ESG management represents a shift away from traditional corporate practices that focus solely on maximizing financial profits. As the key driver of ESG management, companies can enhance their corporate value by increasing revenue, managing risks, and reducing financial costs.

Source: Korea Capital Market Institute (KCMI)

Source: Korea Capital Market Institute (KCMI)