ESG Impact

2

We now live in an era where ESG considerations shape decision-making across sectors.

- Individual Investors’ ESG Considerations

-

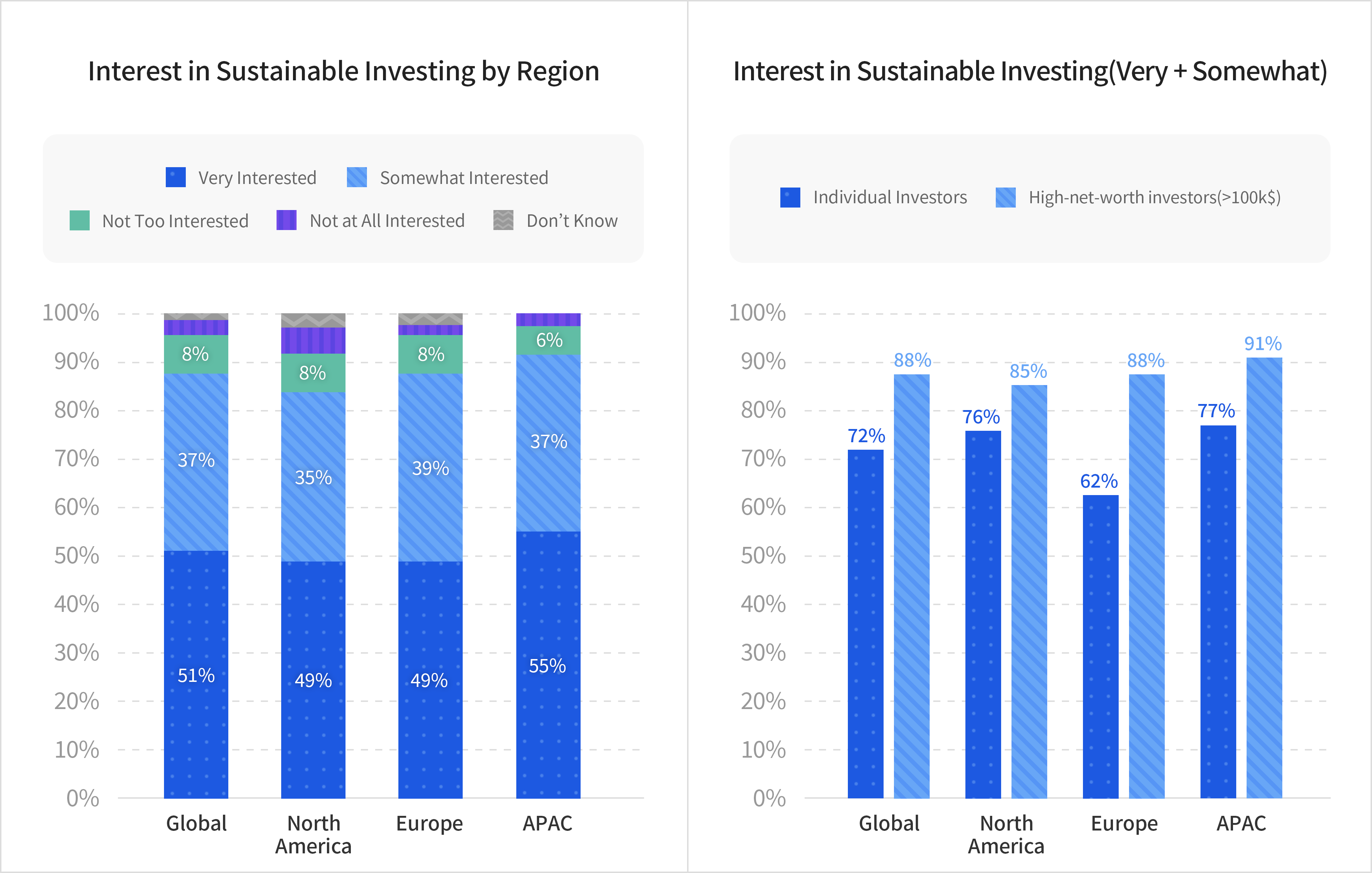

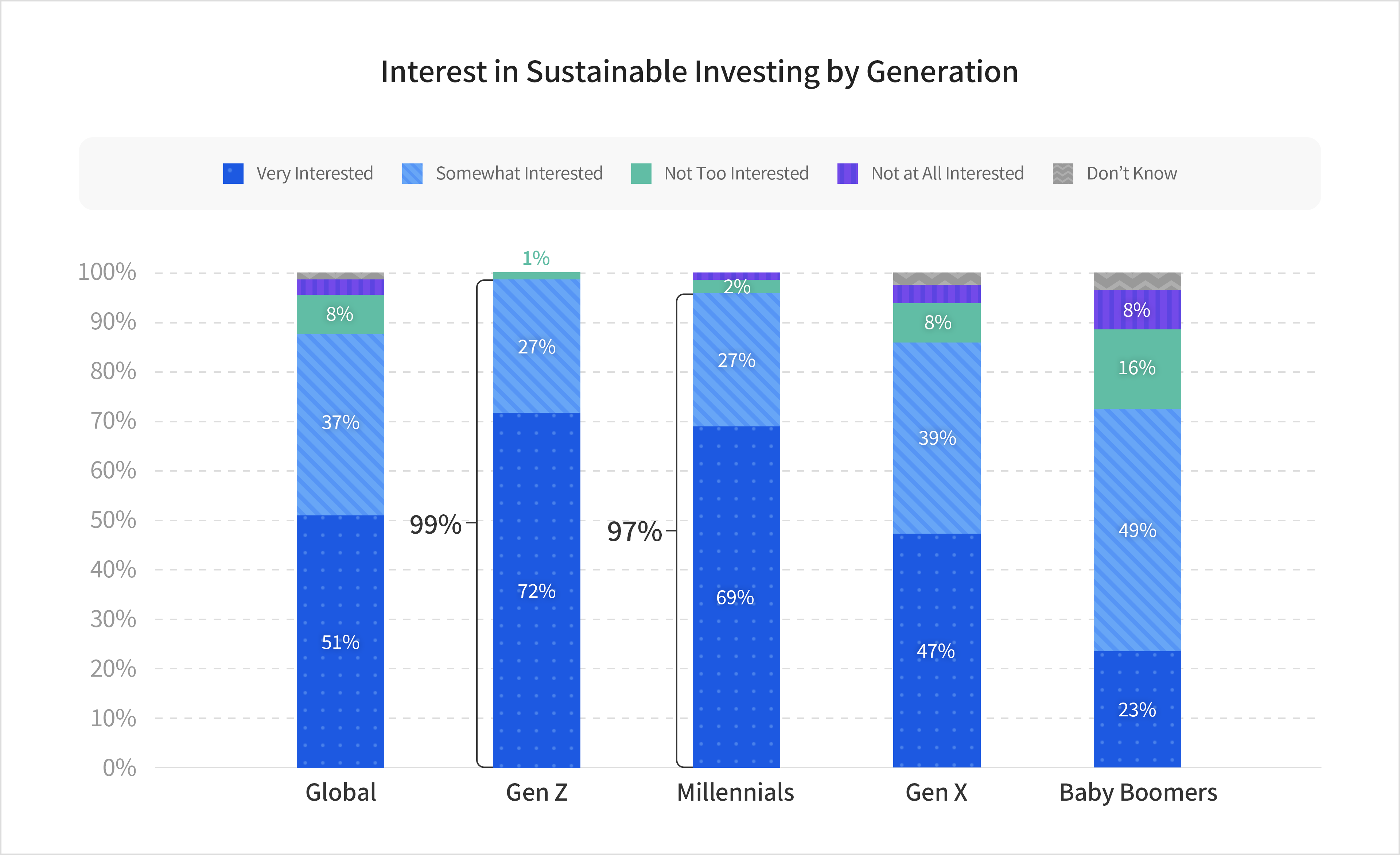

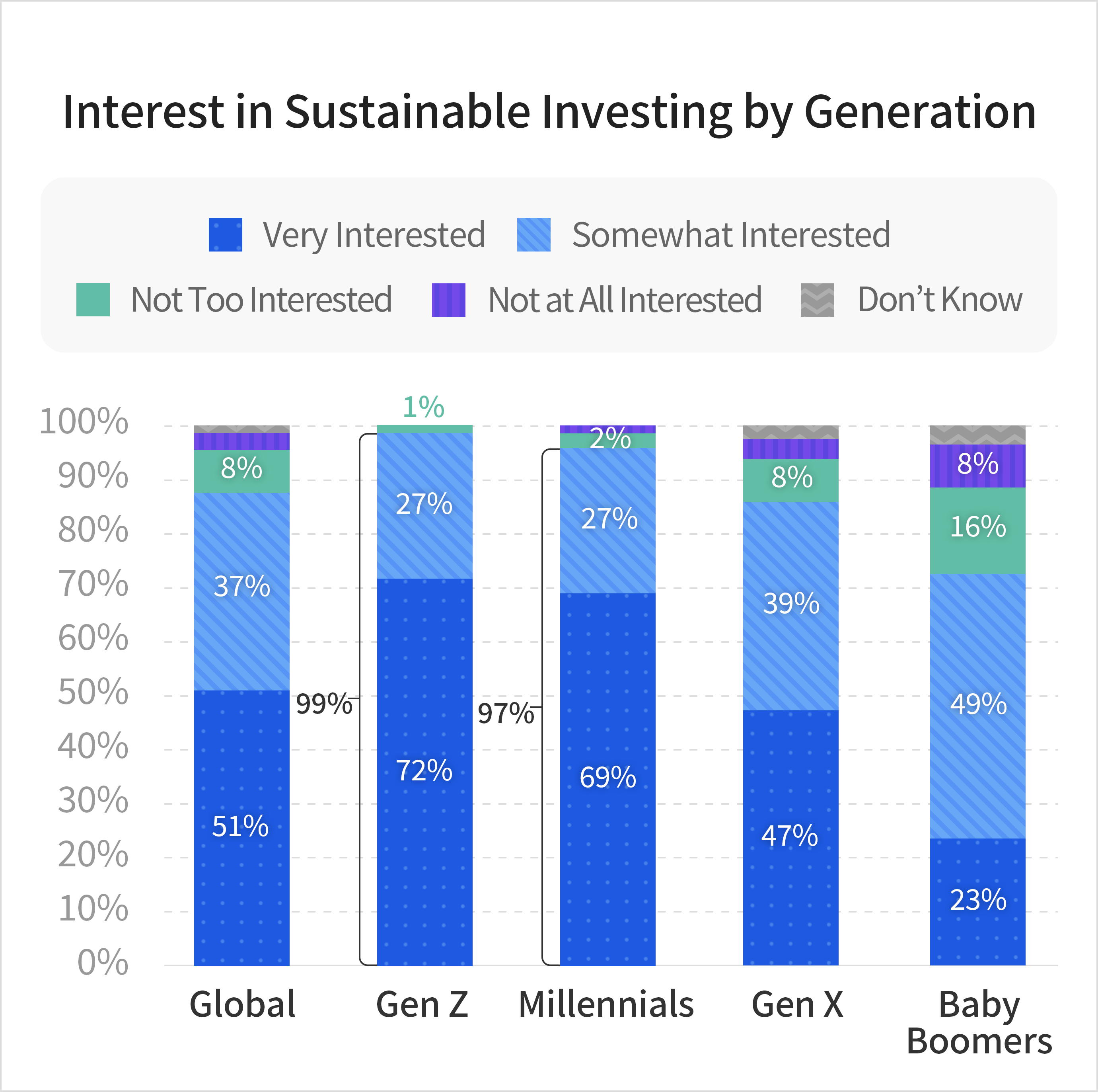

According to a 2025 Morgan Stanley survey of 1,765 individual investors, 88% of global respondents expressed interest in sustainable investing.High-net-worth individuals—those with more than $100,000 in investable assets—showed even stronger interest compared to the general investor population.

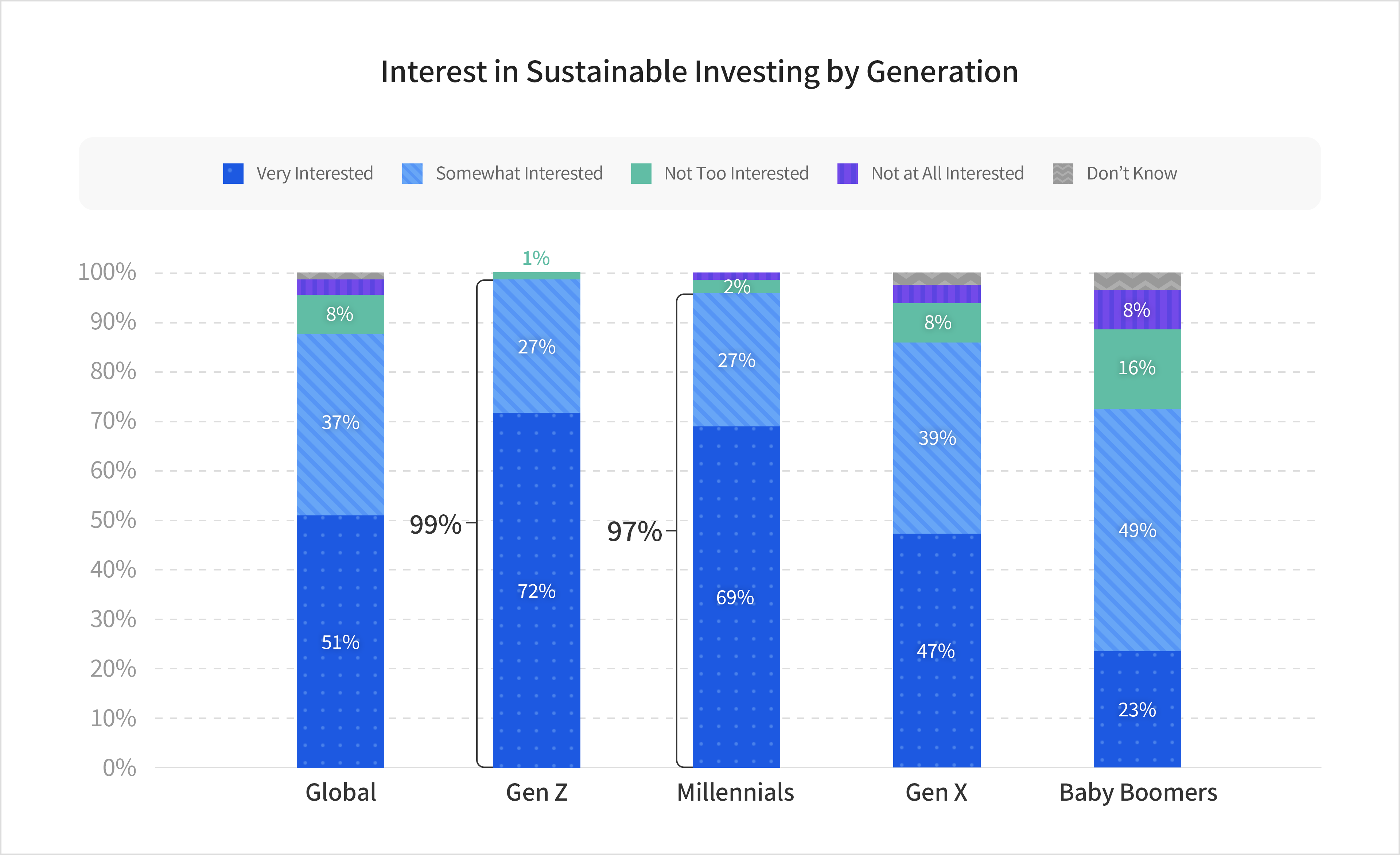

Source: Morgan StanleyMoreover, younger generations such as Millennials and Gen Z demonstrate significantly higher interest in sustainable investing than older generations, including Baby Boomers.This suggests that as younger generations gain greater financial influence, sustainable investing is likely to become an increasingly important priority for investors.

Source: Morgan StanleyMoreover, younger generations such as Millennials and Gen Z demonstrate significantly higher interest in sustainable investing than older generations, including Baby Boomers.This suggests that as younger generations gain greater financial influence, sustainable investing is likely to become an increasingly important priority for investors.

Source: Morgan Stanley

Source: Morgan Stanley - Introduction of the Stewardship Code

-

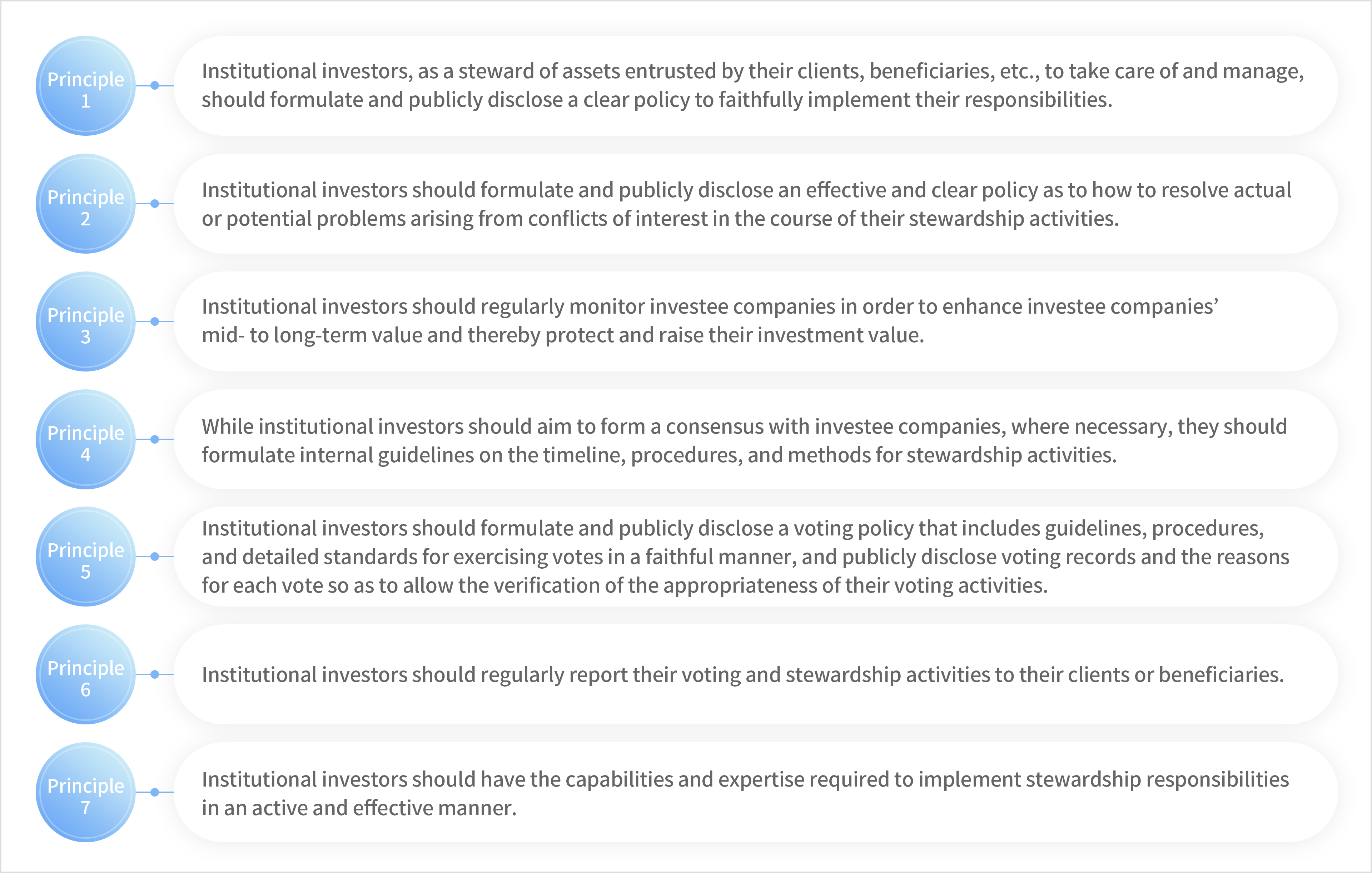

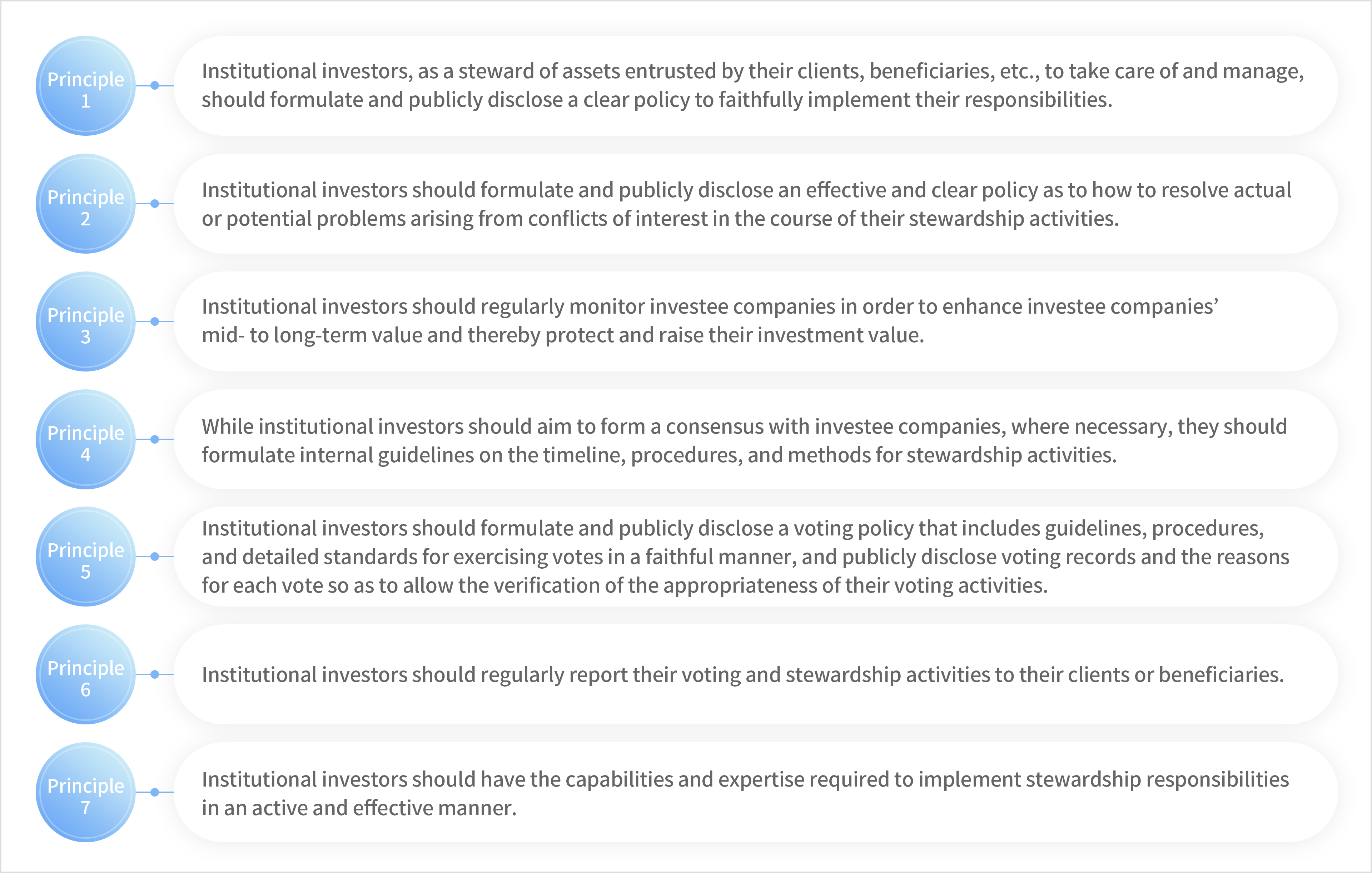

The Korean Stewardship Code, “Principles on the Stewardship Responsibilities of Institutional Investors” presents seven detailed principles and guidelines that institutional investors should implement to fulfill their fiduciary duties when managing assets entrusted by others and investing in domestic listed companies.Institutional investors are expected to monitor investee companies, engage in dialogue when concerns arise, and exercise their shareholder rights responsibly in accordance with these principles.

- Korean Stewardship Code

-

The Korean Stewardship Code sets forth the following seven principles as a soft law.

Source: KCGSFrom 2018 to 2020, institutional investors participating in the Code disclosed a total of 749 stewardship activities—123 in 2018, 286 in 2019, and 331 in 2020—demonstrating a consistent upward trend in stewardship engagement.

Source: KCGSFrom 2018 to 2020, institutional investors participating in the Code disclosed a total of 749 stewardship activities—123 in 2018, 286 in 2019, and 331 in 2020—demonstrating a consistent upward trend in stewardship engagement.

Source: KCGS Report(Sunmin Kim, 2021)In addition, the proportion of domestic institutional investors voting against management has increased significantly since the introduction of the Code.During regular shareholder meetings held between March 2014 and March 2016, private institutional investors voted against management in an average of 1.52% of cases. Following the adoption of the Code, the figure more than doubled to 3.32% between March 2017 and March 2020.Trends in Voting Against Management by Domestic Private Institutional Investors (2014-2020)

Source: KCGS Report(Sunmin Kim, 2021)In addition, the proportion of domestic institutional investors voting against management has increased significantly since the introduction of the Code.During regular shareholder meetings held between March 2014 and March 2016, private institutional investors voted against management in an average of 1.52% of cases. Following the adoption of the Code, the figure more than doubled to 3.32% between March 2017 and March 2020.Trends in Voting Against Management by Domestic Private Institutional Investors (2014-2020)Unit: %, Number of Companies Category Before the Introduction of the Stewardship Code After the Introduction of the Stewardship Code Mar

2014Mar

2015Mar

2016Mar

2017Mar

2018Mar

2019Mar

2020Opposition Vote Ratio(%) 1.19 1.53 1.84 1.93 3.34 3.75 4.26 Number of Companies Voted On 490 604 636 661 719 710 761 Number of Institutional Investors 98 105 97 120 144 172 183 Note : Agenda items related to reporting, contested election, or shareholder proposal are excluded from the analysis.

Source: KCGS Report(Sunmin Kim, 2021)